What's in the CS Professional Exam?

by Swati, on 18 May, 2019 6:00:00 PM

Preparing for the CS Professional Exam?

Make sure you cover everything.

The CS Exam for the June term of this year will be held between June 1st and 10th, 2019. The June term is for those who have already registered. However, if you wish to enroll for the December term, you can register on the ICSI website. You can complete your CS Professional registration if and only after you’ve cleared the CS Foundation and Executive exams.

There is no registration form for this exam as such, since all your information is already in the ICSI system from when you registered for the previous course. You can see the registration process in our blog.

Once you’ve registered successfully, you’ll need to have a proper CS Professional study plan in place in order to prepare and study in a systematic manner. Note down the syllabus that consists of 3 modules and 9 CS Professional papers. Let’s shed some more light on each paper. Note that we will concentrate on the new syllabus (applicable from 2017 onwards).

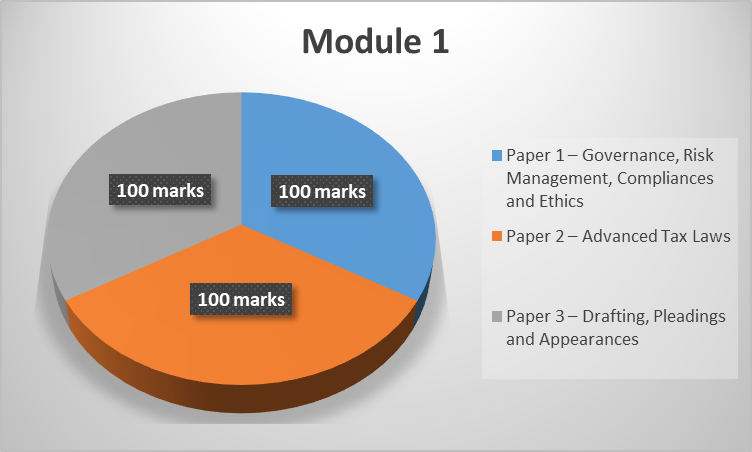

MODULE 1

This contains 3 papers. Each paper is of 3 hours duration and is descriptive:

- Paper 1 – Governance, Risk Management, Compliances and Ethics

-

Paper 2 – Advanced Tax Laws

- Paper 3 – Drafting, Pleadings and Appearances

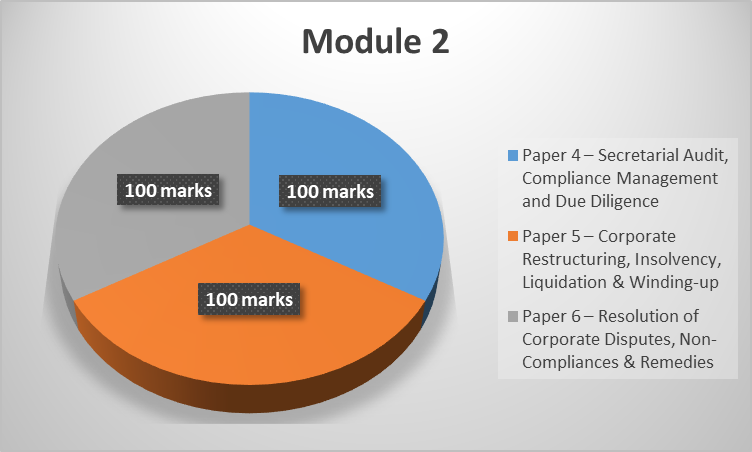

MODULE 2

This contains 3 papers as well. Each paper is of 3 hours' duration and is descriptive:

- Paper 4 – Secretarial Audit, Compliance Management and Due Diligence

- Paper 5 – Corporate Restructuring, Insolvency, Liquidation & Winding-up

- Paper 6 – Resolution of Corporate Disputes, Non-Compliances & Remedies

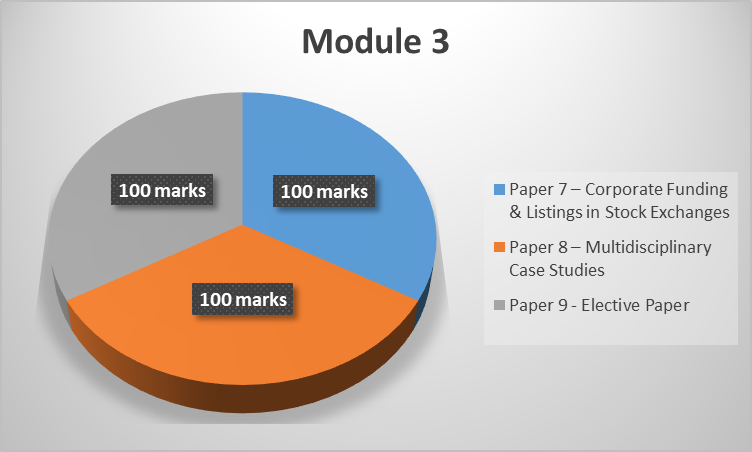

MODULE 3

There are 3 papers in this module. One of the papers is elective where you choose from 9 options. Each paper is of 3 hours' duration and is descriptive.

- Paper 7 – Corporate Funding & Listings in Stock Exchanges

- Paper 8 – Multidisciplinary Case Studies

- Paper 9 - Elective Paper - Choose from one among the following:

- Paper 9.1 - Banking – Law & Practice

- Paper 9.2 - Insurance – Law & Practice

- Paper 9.3 – Intellectual Property Rights: Laws and Practices

- Paper 9.4 – Forensic Audit

- Paper 9.5 – Direct Tax Laws & Practice

- Paper 9.6 – Labour Laws & Practice

- Paper 9.7 – Variations & Business Modelling

Now, in order to learn in an effective way, you will need a CS Professional study plan. Now, let us look in detail about the papers of Module 1:

MODULE 1

Paper 1 – Governance, Risk Management, Compliances and Ethics (100 Marks)

Part 1: Governance (50 Marks)

- Conceptual Framework of Corporate Governance

- Legislative Framework of Corporate Governance in India

- Board Effectiveness

- Board Processes through Secretarial Standards

- Board Committees

- Corporate Policies and Disclosures

- Directors’ Training Development and Familiarization

- Performance Evaluation of Board and Management

- Role of promoter/controlling shareholder, redressal against Oppression and Mismanagement

- Monitoring of group entities and subsidiaries

- Accounting and Audit-related issues

- Related Party Transactions

- Vigil Mechanism/Whistleblower

- Corporate Governance and Shareholders’ Rights

- Corporate Governance and Stakeholders

- Governance and Compliance Risk

- Corporate Governance Forums

- Parameters of Better Governed Companies

- Dealing with Investor Associations, Proxy Services Firms and Institutional Investors

- Family Enterprise and Corporate Governance

Part 2: Risk Management (20 Marks)

- Risk Identification, Mitigation and Audit

Part 3: Compliance (20 Marks)

- Compliance Management

- Internal Control

- Reporting

- Website Management

Part 4: Ethics & Sustainability (10 Marks)

- Ethics & Business

- Sustainability

- Models/Approaches to measure Business Sustainability

- Indian and Contemporary Laws relating to Anti-bribery

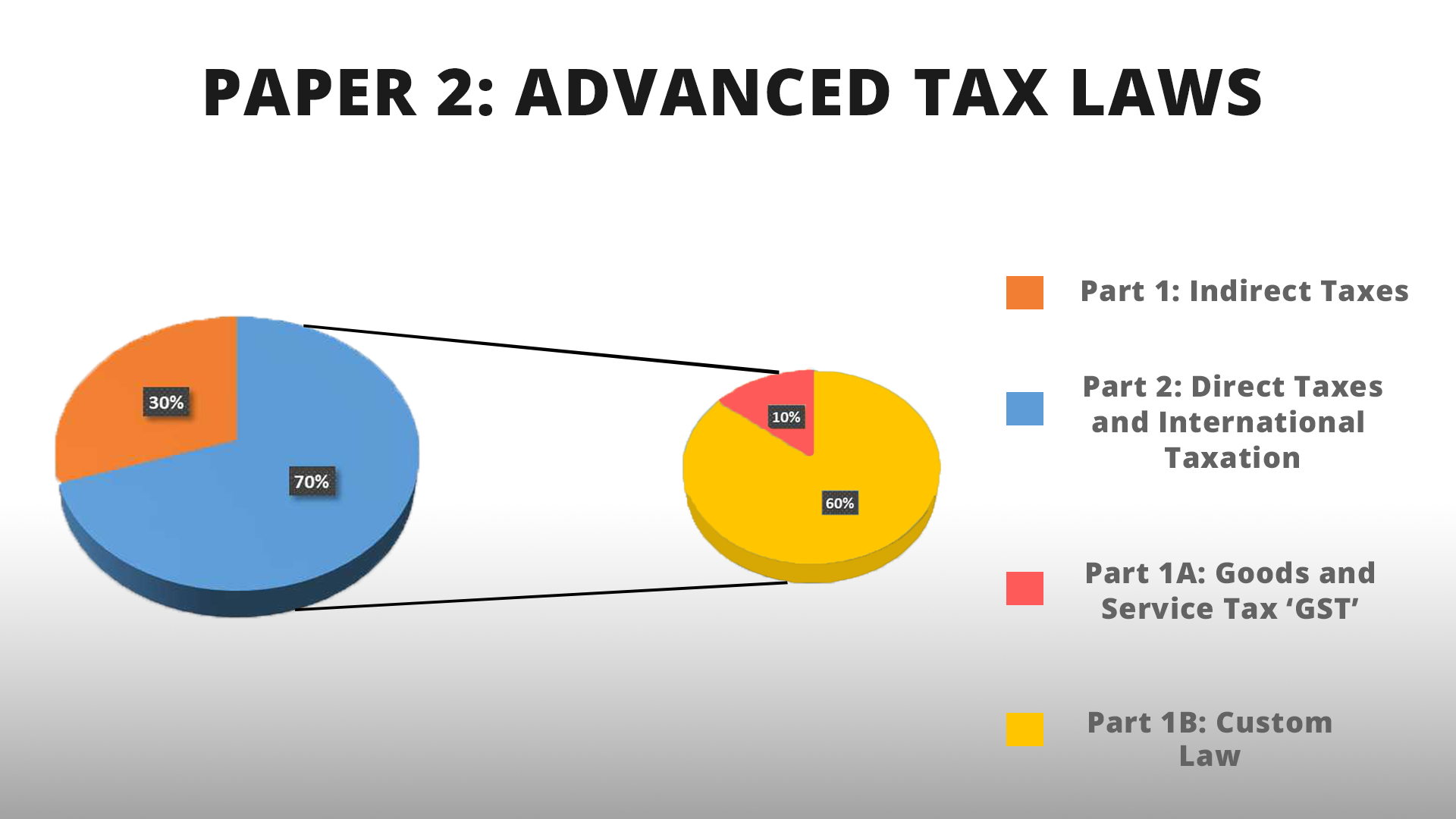

Paper 2 – Advanced Tax Laws (100 Marks)

Part 1: Indirect Taxes (70 Marks)

Part 1A: Goods and Service Tax ‘GST’ (60 Marks)

- An Overview of Goods and Services Tax ‘GST’

- Supply

- Input Tax Credit & Computation of GST Liability

- Procedural Compliance under GST

- Demand and Recovery, Advance Ruling, Appeals and Revision

- Inspection, search, seizure, offences and penalties

- Compliance Rating, Anti-Profiteering, GST practitioners, authorized representative, professional opportunities

- Integrated Goods and Service Tax (IGST)

- Union Territory Goods and Service tax (UTGST)

- GST Compensation to States

- Industry/Sector Specific Analysis

Part 1B: Custom Law (10 Marks)

- Basic Concepts of Customs Law

- Valuation & Assessment of Imported and Export Goods & Procedural Aspects

- Arrival or Departure and Clearance of Goods, Warehousing, Duty Drawback, Baggage and Miscellaneous Provisions

- Advance Ruling, Settlement Commission, Appellate Procedure, Offences and Penalties

- Foreign Trade Policy (FTP)

Part 2: Direct Tax & International Taxation (30 Marks)

- Corporate Tax Planning & Tax Management

- Taxation of Companies, LLP and Non-resident

- General Anti Avoidance Rules ‘GAAR

- Basics of International Taxation – Transfer Pricing and Place of Effective Management (POEM)

- Tax Treaties

- Income Tax Implication on specified transactions

Paper 3 – Drafting, Pleadings and Appearances (100 Marks)

- Judicial & Administrative Framework

- General Principles of Drafting and relevant Substantive Rules

- Secretarial Practices and Drafting

- Drafting and Conveyancing relating to Various Deeds and Agreements

- Drafting of Agreements, Documents and Deeds

- Pleadings

- Art of Writing Opinions

- Appearances & Art of Advocacy

We now come to the papers of Module 2:

MODULE 2

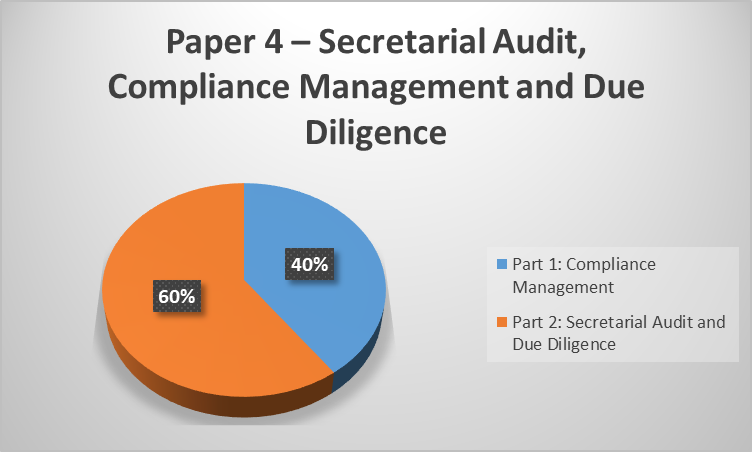

Paper 4 – Secretarial Audit, Compliance Management and Due Diligence (100 Marks)

Part 1: Compliance Management (40 Marks)

- Compliance Framework

- Compliances – Entry wise, Activity wise, Sector wise, Industry Specific, State and Local applicable laws

- Documentation & Maintenance of Records

- Search and Status Report

- KYC

- Signing and Certification

- Segment-wise Role of Company Secretaries

Part 2: Secretarial Audit and Due Diligence (60 Marks)

- Audits

- Secretarial Audits

- Internal Audit & Performance Audit

- Concepts and Principles of Other Audits

- Audit Engagement

- Audit Principles and Techniques

- Audit Process and Documentation

- Forming an Opinion & Reporting

- Secretarial Audit – Fraud Detection & Reporting

- Quality Review

- Values, Ethics and Professional Conduct

- Due Diligence

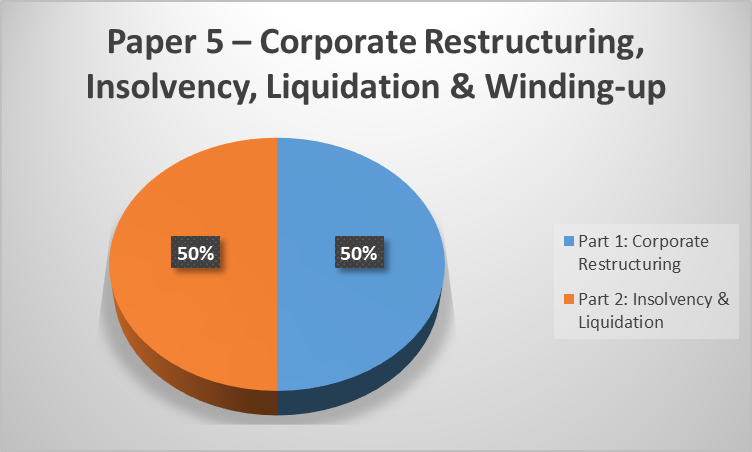

Paper 5 – Corporate Restructuring, Insolvency, Liquidation & Winding-up (100 Marks)

Part 1: Corporate Restructuring (50 Marks)

- Types of Corporate Restructuring

- Acquisition of Company/Business

- Planning & Strategy

- Process of M & A Transactions

- Document-Merger & Amalgamation

- Valuation of Business and Assets for Corporate Restructuring

- Accounting in Corporate Restructuring – Concept and Accounting Treatment

- Taxation & Stamp Duty aspects of Corporate Restructuring

- Competition Act

- Regulatory approvals of scheme

- Appearance before NCLT/NCLAT

- Fast Track Mergers

- Cross Border Mergers

Part 2: Insolvency & Liquidation (50 Marks)

- Insolvency

- Petition for Corporate Insolvency Resolution Process

- Role, Functions and Duties of IP/IRP/RP

- Resolution Strategies

- Convening and Conduct of Meetings of Committees of Creditors

- Preparation & Approval of Resolution Plan

- Individual/Firm Insolvency

- Fresh Start Process

- Debt Recovery

- Debt Recovery & SARFAESI

- Cross Border Insolvency

- Liquidation on or after failing of RP

- Voluntary Liquidation

- Winding-up by Tribunal under the Companies Act, 2013

Paper 6 – Resolution of Corporate Disputes, Non-Compliances & Remedies (100 Marks)

- Shareholders’ Democracy & Rights

- Corporate Disputes

- Fraud under Companies Act and IPC

- Misrepresentation and Malpractices

- Regulatory Action

- Default, Adjudication, prosecutions and penalties under the Companies Act, Securities Laws, FEMA, COFEPOSA, Money Laundering, Competition Act, Labour Laws & Tax Laws

- Fines, Penalties and Punishments under various laws

- Civil and Criminal Trial Procedure and Process

- Relief and Remedies

- Crisis Management, Professional Liability, D&O Policy, other Risk and Liability Mitigation approaches

Now, we come to the papers of Module 3.

MODULE 3

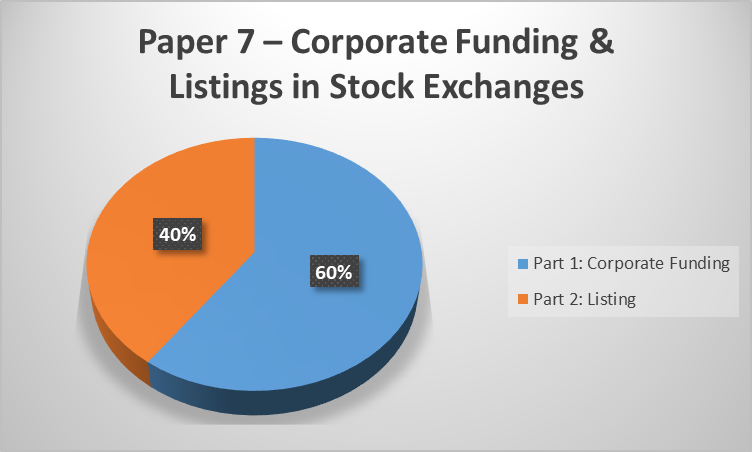

Paper 7 – Corporate Funding & Listings in Stock Exchanges (100 Marks)

Part 1: Corporate Funding (60 Marks)

- Indian Equity-Public Funding

- Indian Equity-Private Funding

- Indian Equity – Non-fund based

- Debt Funding – Indian fund-based

- Debt Funding – Indian non-fund based

- Foreign Funding – Instruments & Institutions

- Other Borrowing Tools

- Non-Convertible Instruments – Non-Convertible Redeemable Preference Shares (NCRPs), etc.

- Securitization

Part 2: Listing (40 Marks)

- Listing-Indian Stock Exchanges

- International Listing

- Various Procedural requirements for issue of Security and Listing

- Preparing a Company for an IPO and Governance requirements thereafter, Appraising the Board and other functions in the organizations regarding the Post IPO/Listing Governance changes.

- Documentation & Compliances

Paper 8 – Multidisciplinary Case Studies (100 Marks)

- Corporate Laws including Company Law

- Securities Laws

- FEMA and other Economic and Business Legislations

- Insolvency Law

- Competition Law

- Business Strategy and Management

- Interpretation of Law

- Governance Issues

Paper 9: Elective Paper

This is an elective paper where you choose from among the following:

Paper 9.1 - Banking – Law & Practice (100 Marks)

- Overview of Indian Banking System

- Regulatory Framework of Banks

- Control over Organization Of Banks

- Regulation of Banking Business

- Banking Operations

- IT in Banking

- Payment and Collection of Cheques and Other Negotiable Instruments

- Case Laws on Responsibility of Paying Bank

- Case Laws on Responsibility of Collective Bank

- Various Government Schemes

- Consumer Protection

- Loans and Advances

- Securities for Banker’s Loans

- Documentation

- Calculation of Interest and Annuities

- Calculation of YTM

- Foreign Exchange Arithmetic

- Non-Performing Assets

- Final Accounts of Banking Companies

- Risk Management in Banks and Basel Accords

Paper 9.2 - Insurance – Law & Practice (100 Marks)

- Concept of Insurance; Risk Management

- Regulatory Framework of Insurance Business in India

- Life Insurance – Practices

- Life Insurances – Underwriting

- Applications of Life Insurance

- Life Insurance – Finance

- Health Insurance

- General Insurance – Practices and Procedures

- Fire & Consequential Loss Insurance

- Marine Insurance

- Agricultural Insurance

- Motor Insurance

- Liability Insurance

- Aviation Insurance

- Risk Management

- Corporate Governance for Insurance Companies

Paper 9.3 – Intellectual Property Rights: Laws and Practices (100 Marks)

- Introduction

- Types of Intellectual Property – Origin and Development: An Overview

- Role of International Institutions

- Patents

- Indian Patent Law

- Patent Databases & Patent Information System

- Preparation of Patent Documents

- Process for Examination of Patent Application

- Patent Infringement

- Recent Developments in Patent System

- Trademarks

- Copyrights

- Industrial Designs

- Geographical Indications

- Layout Designs of Integrated Circuits

- The Protection of Plant Varieties and Farmers’ Rights

- Protection of Trade Secrets

- Key Business concerns in Commercializing Intellectual Property Rights

- Case Laws, Case Studies and Practical Aspects

Paper 9.4 – Forensic Audit (100 Marks)

- Introduction

- Fraud and Audit

- Audit and Investigations

- Forensic Audit – Laws and Regulations

- Forensic Audit and Indian Evidence Law

- Cyber Forensics

- Case Laws, Case Studies and Practical Aspects

Paper 9.5 – Direct Tax Laws & Practice (100 Marks)

- An Overview of Income Tax Act, 1961

- Computation of Income under the head of Salary

- Computation of Income under the head of House Property

- Computation of Income – Profits and Gains from Business and Profession

- Computation of Income under the head of Capital Gains

- Computation of Income from Other Sources

- Exemptions/Deductions, Clubbing provisions, Set Off and/or Carry Forward or Losses, Rebate and Relief

- Computation of Total Income and Tax Liability

- TDS/TCS, Returns, Refund & Recovery

- Tax Planning & Tax Management

- International Taxation – An Overview

- Recent Case Laws

Paper 9.6 – Labour Laws & Practice (100 Marks)

- Constitutions and Labour Laws

- International Labour Organization

- Law of Welfare & Working Condition

- Law of Industrial Relations

- Law of Wages

- Social Security Legislations

- The Labour Laws (Simplification of Procedure for Furnishing Returns and Maintaining Registers by Certain Establishments) Act, 1988

- Labour Codes

- Industrial and Labour Laws Audit covering the above Acts and other Industry Specific Ac

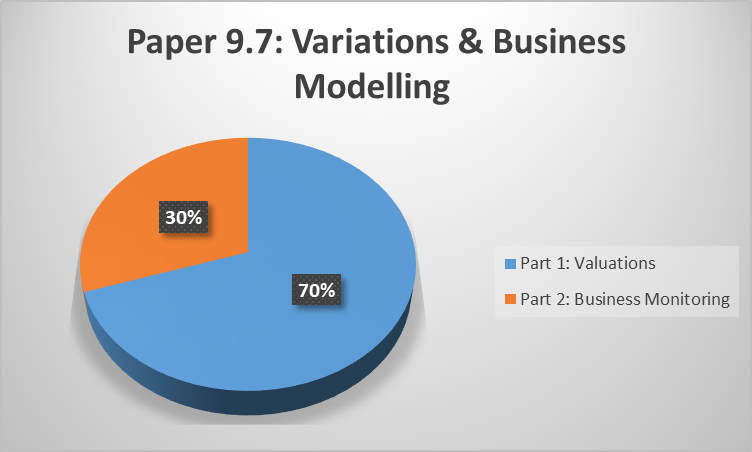

Paper 9.7 – Variations & Business Modelling (100 Marks)

Part 1: Valuations (70 Marks)

- Overview of Business Valuation

- Purpose of Valuation

- International Valuation Standards of Overview

- Valuation Guidance Resources in India

- Business Valuation Methods

- Steps to Establish the Business Worth

- Valuation of Tangibles

- Valuation of Intangible

- Accounting for share-based payment (Ind AS 102)

- Valuation during Mergers & Acquisitions

- Valuation of various magnitudes of Business Organizations

- Valuation of Business during Distressed Sale

Part 2: Business Monitoring (30 Marks)

- Insolvency – Concepts and Evolution

- Introduction to Insolvency and Bankruptcy Code

- Corporate Insolvency Resolution Process

- Insolvency Resolution of Corporate Persons

- Resolutions Strategies

- Fast Track Corporation Insolvency Resolution Process

- Liquidation of Corporate Persons

- Voluntary Liquidation of Companies

- Adjudication and Appeals for Corporate Persons

- Debt Recovery and Secularization

- Winding-up by Tribunal

- Cross Border Insolvency

- Insolvency Resolution of Individual and Partnership Firms

- Bankruptcy Order for Individuals and Partnership Firms

- Bankruptcy for Individual and Partnership Firms

- Fresh Start Process

- Professional and Ethical Practices for Insolvency Practitioners

Study these CS Professional subjects well but before anything else be sure to check your CS Professional eligibility and registration process.

Passing Requirements And Passing Tips

You can appear for either one or all modules of papers. Appearing for a module means that you’ll have to appear for all papers in that module. Note that you’ll have to pass all modules of papers to move on to the next step.

If you appear for only one module, the minimum requirement to pass the module is that:

- you obtain a minimum of 40% marks in each paper of the module and

- you obtain a minimum of 50% marks in the aggregate of all papers of the module taken together.

If you appear for all modules simultaneously, then you clear all modules if:

- you meet the minimum requirements to clear a module individually or

- you obtain a minimum of 40% marks in each paper of all the modules, and a minimum of 50% marks in the aggregate of all papers of all modules taken together.

Now, you can appear for the modules as many times as you want. And your next attempt can be made the next time ICSI holds the exam. That is, suppose you’ve failed a group in your May attempt. You can appear for the same group in November! Similarly, if you choose to appear for only one group and pass it, you can appear for the next group the next time ICSI conducts the exam.

You can also get certain exemptions depending on marks obtained from previous attempts.

As for tips to pass?

Well, the problem is that as you can see, the CS Executive Exam covers a lot of ground. With adequate preparation, and concentration on your fundamentals, there’s no reason why you shouldn’t pass.

Focus your attention on papers in which you are relatively weak. And score as much as possible in your strong areas. Beware of the minimum requirements.

As a tip specific to this exam, we think that, depending on your prep, you should try to clear all modules at the same time. This is contrary to popular belief. The reason is because of the way ICSI structures the passing requirements. It is, in fact, easier to meet the passing requirements for passing the modules together if you have studied thoroughly. An added benefit is that it's also easier to get exemptions if needed. Not only that, it does save you an attempt!

In the end though, if you really feel that your prep is lacking in a module, then you might want to consider a single module attempt. But we recommend this only as a last resort.

Also, if you are feeling nervous before the exam, don't be. Check out this post for tips on how to calm your nerves.

While the ICSI will be providing you study material for the exam, you could also take your preparation a step further by opting for CS Professional online classes, by signing up with LearnCab. Through our CS Professional exam video lectures, you can experience learning on a new level.

So, how can you gain access to the best online classes for CS Executive final exam? Download our app or access our website on your desktop.

This is just the syllabus for the exam but it never hurts to over-prepare. With our help, you can increase your chances of clearing the exam by opting for our CS Professional online classes. Sign up with LearnCab and gain access to the best online classes for the CS Professional exam.

Download our app or use our desktop version. Stay tuned to our blog for notifications on admissions, examinations and CS Professionals results. It’s all here; all in one place. Get started today!