What's in the CS Executive Exam?

by Swati, on 17 May, 2019 6:00:00 PM

Preparing for the CS Executive Exam?

Let us guide you.

The CS Executive Exam is the second level under the Company Secretary umbrella and is conducted by the ICSI as well. If you wish to register for this exam, read our blog for step-by-step instructions.

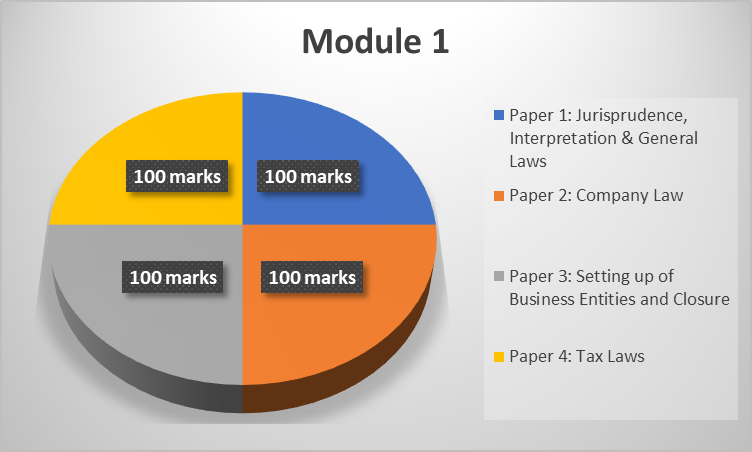

Today, we will learn, in detail, what CS Executive Syllabus will consist of. There are 2 modules and 8 CS Executive Papers. Note that we will concentrate on the new syllabus (applicable from 2017 onward).

All About the CS Executive Exam

MODULE 1:

Paper 1: Jurisprudence, Interpretation & General Laws

Paper 2: Company Law

Paper 3: Setting up of Business Entities and Closure

Paper 4: Tax Laws

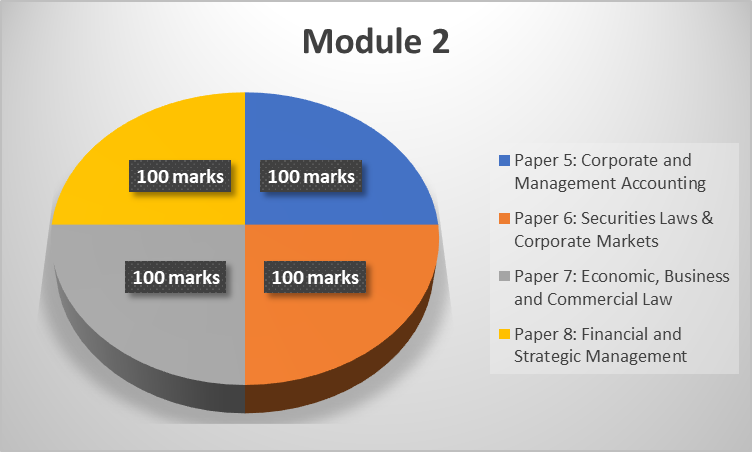

MODULE 2

Paper 5: Corporate and Management Accounting

Paper 6: Securities Laws & Corporate Markets

Paper 7: Economic, Business and Commercial Law

Paper 8: Financial and Strategic Management

Each of these papers is of 3 hours duration and worth 100 marks. In order to learn in an effective way, you will need a CS Executive study plan. Now, let us look in detail about the papers of Module 1:

Paper 1 – Jurisprudence, Interpretation & General Laws (Marks: 100)

- Sources of Law

- Constitution of India

- Interpretation of Statutes

- General Clauses Act, 1897

- Administrative Laws

- Law of Torts

- Limitation Act, 1963

- Civil Procedure Code, 1908

- Indian Penal Code, 1860

- Criminal Procedure Code, 1973

- Indian Evidence Act, 1973

- Special Courts, Tribunals under Companies Act & Other Legislations

- Arbitration and Conciliation Act, 19

- Indian Stamp Act, 18

- Registration Act, 1908: Registration of Documents

- Right to Information Act, 20

- Information Technology Act, 2000

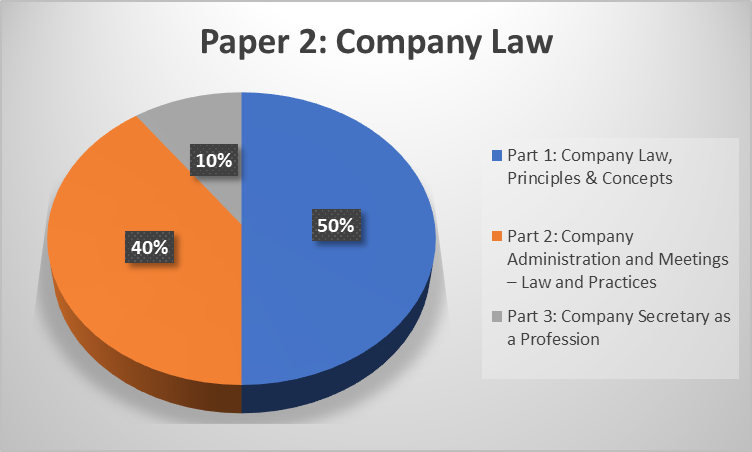

Paper 2 – Company Law (100 Marks)

Part 1: Company Law, Principles & Concepts (50 Marks)

- Introduction to Company Law

- Shares and Share Capital

- Members and Shareholders

- Debt Instruments

- Charges

- Distribution of Profits

- Corporate Social Responsibility

- Accounts, Audits and Auditors

- Transparency and Disclosures

- An overview of Inter-Corporate Loans, Investments, Guarantees and Security, Related Party Transactions

- Registers and Records

- An Overview of Corporate Reorganization

- Introduction to MCA 21 and filing in XBRL

- Global Trends and Developments in Company Law

Part 2: Company Administration and Meetings – Law and Practices (40 Marks)

- Board Constitution and its Powers

- Directors

- Key Managerial Personnel (KMP’s) and their Remuneration

- Meetings of Board and its Committees

- General Meetings

- Virtual Meetings

Part 3: Company Secretary as a Profession (10 Marks)

- Legal framework governing Company Secretaries

- Secretarial Standards Board

- Mega Firms

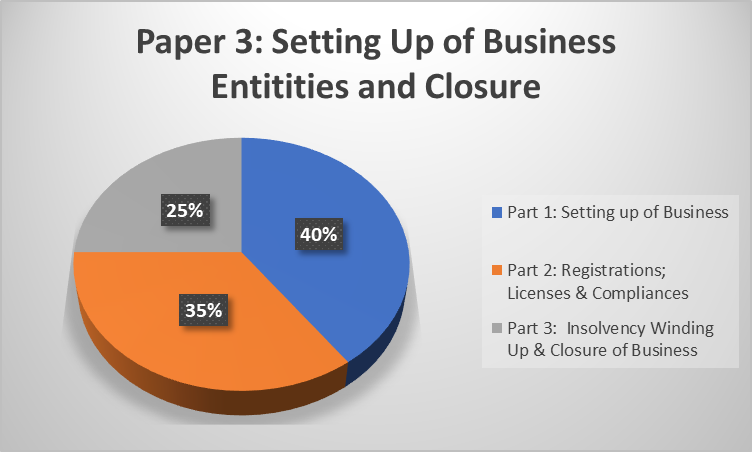

Paper 3 – Setting up of Business Entities and Closure (100 Marks)

Part 1: Setting up of Business (40 Marks)

- Choice of Business Organisation

- Company

- Charter Documents of Companies

- Legal Status of Registered Companies

- Limited Liability Partnership

- Other forms of Business Organisations

- Institutions Not For Profit & NGOs

- Financial Services Organisation

- Start-ups

- Joint Ventures; Special Purpose Vehicles

- Setting up of Business outside India

- Conversion of Existing Business Entity

Part 2: Registrations; Licenses & Compliances (35 Marks)

- Various Initial Registrations and Licenses

- Maintenance of Registers and Records

- Identifying Property Laws

- Intellectual Property Laws

- Compliances under Labour Laws (Provisions applicable for setting up of business)

- Compliances relating to Environmental Laws (Provisions applicable for setting up of business)

Part 3: Insolvency Winding Up & Closure of Business (25 Marks)

- Dormant Company

- Strike off and restoration of name of the company and LLP

- Insolvency Resolution process; Liquidation and Winding-up

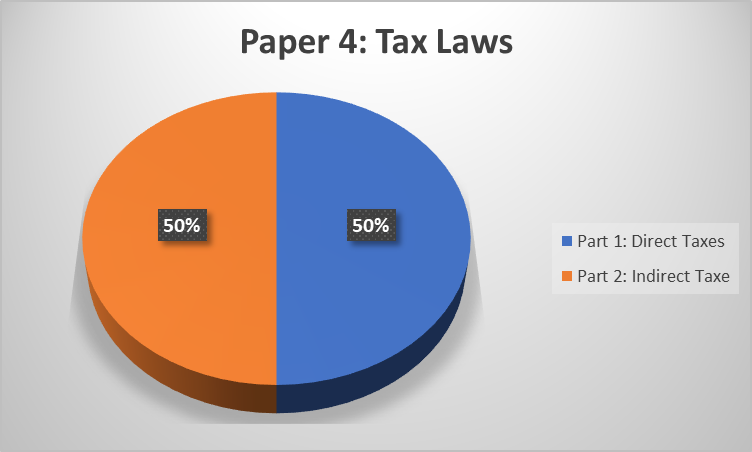

Paper 4 – Tax Laws (100 Marks)

Part 1: Direct Taxes (50 Marks)

- Direct Taxes at a Glance

- Basic Concepts of Income Tax

- Incomes which do not form part of Total Income

- Computation of Income under Various Heads

- Clubbing provisions and Set Off and/or Carry Forward of Losses

- Deductions from Gross Total Income & Rebate and Relief

- Computation of Total Income and Tax Liability of various entities

- Classification and Tax Incidence on Companies

- Procedural Compliance

- Assessment, Appeals & Revision

Part 2: Indirect Taxes (50 Marks)

(A) Goods and Service Tax

- Concept of Indirect Taxes at a glance

- Basics of Goods and Services Tax ‘GST’

- Concept of time, Value & Place of Taxable Supply

- Input Tax Credit & Computation of GST Liability – Overview

- Procedural Compliance under GST

- Basic overview on Integrated Goods and Service Tax(IGST), Union Territory Goods and Service Tax (UTGST) and GST Compensation to States

(B) Customs Act

- Overview of Customs Act

We now come to the papers of Module 2:

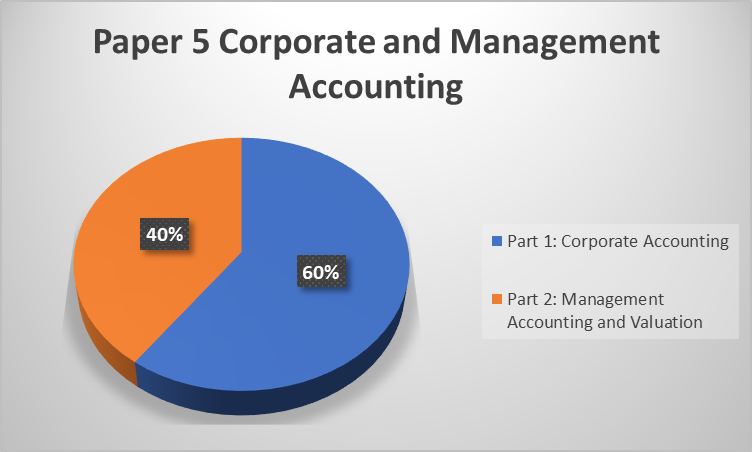

Paper 5 – Corporate and Management Accounting (100 Marks)

Part 1: Corporate Accounting (60 Marks)

- Introduction to Financial Accounting

- Introduction to Corporate Accounting

- Accounting for Share Capital

- Accounting for Debentures

- Related Aspects of Company Accounts

- Financial Statements Interpretation

- Consolidation of Accounts as per Companies Act, 2013

- Corporate Financial Reporting

- Cash Flow Statements

- Accounting Standards (AS)

- National and International Accounting Authorities

- Adoption, Convergence and Interpretation of International Financial Reporting Standards (IFRS) and Accounting Standards in India

Part 2: Management Accounting and Valuation (40 Marks)

- An Overview of Cost

- Cost Accounting Records & Cost Audit under Companies Act, 2013

- Budget, Budgeting and Budgetary Control

- Ration Analysis

- Management Reporting (Management Information Systems)

- Decision Making Tools

- Valuation Principles & Framework

- Valuation of Shares, Business and Intangible Assests

- Accounting for Share based payments (IndAS 102)

- Business and Intangible Assets

- Methods of Valuation

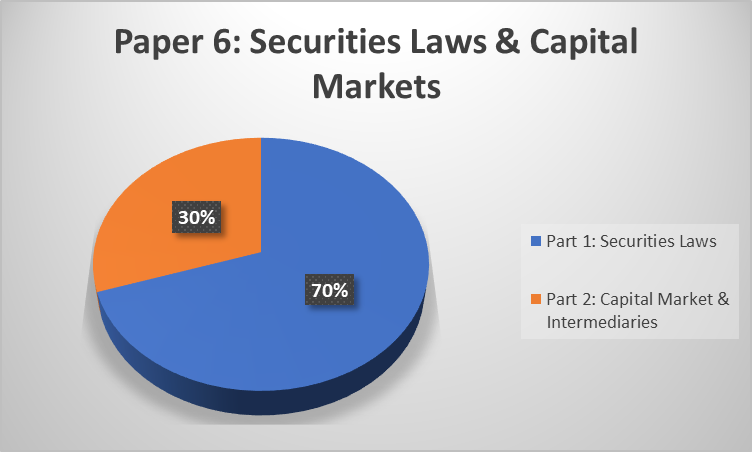

Paper 6 – Securities Laws & Capital Markets (100 Marks)

Part 1: Securities Laws (70 Marks)

- Securities Contracts (Regulations) Act 1956

- Securities and Exchange Board of India Act, 1992

- Depositories Act, 1996

- An Overview of SEBI(Issue of Capital and Disclosure Requirements) Regulations, 2009

- An Overview of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015

- An Overview of SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011

- SEBI (Buyback of Securities) Regulations, 1998

- SEBI (Delisting of Equity Shares) Regulations, 2009

- An Overview of SEBI (Share Based Employee Benefits) Regulations, 2014

- An Overview of SEBI (Issue of Sweat Equity) Regulations, 2002

- SEBI (Prohibition of Insider Trading) Regulations, 2002

- Mutual Funds

- Collective Investment Schemes

- SEBI(Ombudsman) Regulations, 2003

Part 2: Capital Market & Intermediaries (30 Marks)

- Structure of Capital Market – a) Primary Market; b) Secondary Market

- Securities Market Intermediaries

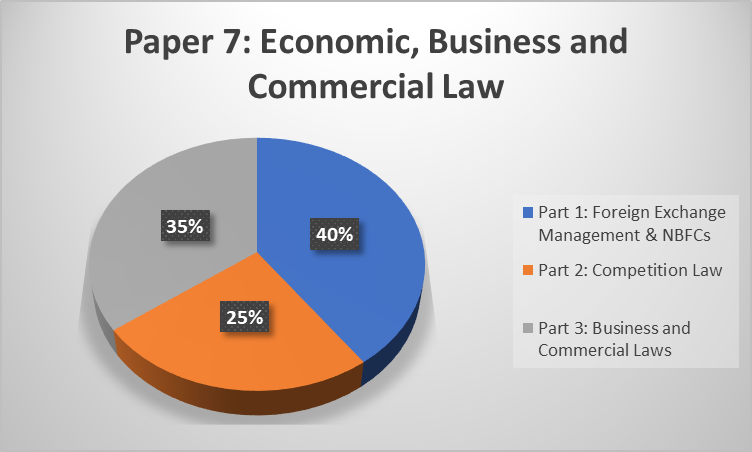

Paper 7 – Economic, Business and Commercial Law (100 Marks)

Part 1: Foreign Exchange Management & NBFCs (40 Marks)

- Reserve Bank of India Act, 1934

- Foreign Exchange Management Act, 1999

- Foreign Exchange Transactions & Compliances

- Foreign Contribution (Regulation) Act, 2010

- Foreign Investments –Regulations & FDI Policy

- Overseas Direct Investment

- Liberalized Remittance Scheme

- External Commercial Borrowings (ECB)

- Foreign Trade Policy & Procedure

- Non-Banking Finance Companies (NBFCs)

- Special Economic Zones Act, 2005

Part 2: Competition Law (25 Marks)

- Competition Act, 2002

Part 3: Business and Commercial Laws (35 Marks)

- Consumer Protection Act, 1986

- Essential Commodities Act, 1955

- Legal Metrology Act, 2009

- Transfer of Property Act, 1882

- Real Estate (Regulation and Development) Act, 2016

- Benami Transaction Prohibitions (Act)

- Prevention of Money Laundering

- Indian Contracts Act, 1872

- Specific Relief Act, 1963

- Sales of Goods Act, 1930

- Partnership Act, 1932

- Negotiable Instrument Act, 1881

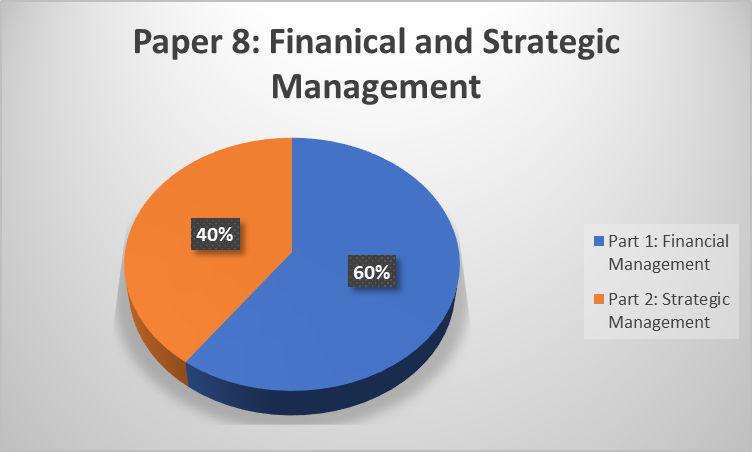

Paper 8 – Financial and Strategic Management (100 Marks)

Part 1: Financial Management (60 Marks)

- Nature and Scope of Financial Management

- Capital Budgeting

- Capital Structure

- Sources of raising long-term finance and Cost of Capital

- Project Finance

- Dividend Policy

- Working Capital

- Security Analysis

- Portfolio Management

Part 2: Strategic Management (40 Marks)

- Introduction to Management

- Introduction to Strategic Management

- Business Policy and Formulation of Functional Strategy

- Strategic Analysis and Planning

- Strategic Implementation and control

- Analysing Strategic Edge

These are the CS Executive subjects in a nutshell but before starting to prepare for the exam, be sure to check your CS Executive Eligibility.

Now let us see what documents you for CS Executive Registration.

Documents Needed for CS Executive Registration

When registering for the CS Executive exam, keep the following documents ready:

- Passport-size photograph

- Signature

- Certificate of Birth OR (10th standard Pass Certificate)

- 12th standard Pass Certificate

- Degree Certificate

- Consolidated Mark sheet

- Category Certificate (other than General)

- Government-issued ID – Aadhar card/Passport/Voter ID/Ration card

Find our more about eligibility requirements and registration process in our blog post about this very topic.

Passing Requirements And Passing Tips

You can appear for either one or both modules of papers. Appearing for a module means that you’ll have to appear for all papers in that module. Note that you’ll have to pass both modules of papers to move on to the next step.

If you appear for only one module, the minimum requirement to pass the module is that:

- you obtain a minimum of 40% marks in each paper of the module and

- you obtain a minimum of 50% marks in the aggregate of all papers of the module taken together.

If you appear for both modules simultaneously, then you clear both modules if:

- you meet the minimum requirements to clear a module individually or

- you obtain a minimum of 40% marks in each paper of both the modules, and a minimum of 50% marks in the aggregate of all papers of both modules taken together.

Now, you can appear for the modules as many times as you want. And your next attempt can be made the next time ICSI holds the exam. That is, suppose you’ve failed a group in your May attempt. You can appear for the same group in November! Similarly, if you choose to appear for only one group and pass it, you can appear for the next group the next time ICSI conducts the exam.

You can also get certain exemptions depending on marks obtained from previous attempts.

As for tips to pass?

Well, the problem is that as you can see, the CS Executive Exam covers a lot of ground. With adequate preparation, and concentration on your fundamentals, there’s no reason why you shouldn’t pass.

Focus your attention on papers in which you are relatively weak. And score as much as possible in your strong areas. Beware of the minimum requirements.

As a tip specific to this exam, we think that, depending on your prep, you should try to clear both modules at the same time. This is contrary to popular belief. The reason is because of the way ICSI structures the passing requirements. It is, in fact, easier to meet the passing requirements for passing both modules together if you have studied thoroughly. An added benefit is that it's also easier to get exemptions if needed. Not only that, it does save you an attempt!

In the end though, if you really feel that your prep is lacking in a module, then you might want to consider a single module attempt. But we recommend this only as a last resort.

Also, if you are feeling nervous before the exam, don't be. Check out this post for tips on how to calm your nerves.

While the ICSI will be providing you study material for the exam, you could also take your preparation a step further by opting for CS Executive online classes, by signing up with LearnCab. Through our CS Executive exam video lectures, you can experience learning on a new level.

So, how can you gain access to the best online classes for CS Executive final exam? Download our app or access our website on your desktop.

Also, if you want to find out more about our offerings, click on the button below:

Stay tuned on notifications on admissions, examinations and CS Executive Results.

We’ll be back soon with another informative blog!